Do you dare spend money on cellular house parks?

If not… why not?

Cell house parks, aka manufactured housing communities, are among the many most secure and worthwhile asset lessons in America. And in contrast to multifamily, the place I had deliberate to take a position for the remainder of my life, manufactured housing remains to be “just a little bit undiscovered.”

I’m coming into my third decade of actual property investing later this 12 months, and I’ve had 4 brushes with manufactured housing. One produced zero outcomes, and the second was a catastrophe. The third produced minimal outcomes, and I assumed that may be my final go-round on this sector.

However our agency has invested thousands and thousands into cellular house parks prior to now few years, and we couldn’t be happier. We now have found a hidden jewel within the industrial actual property realm, and we, together with our pals and traders, are reaping huge rewards within the type of revenue, appreciation, and tax benefits.

However there are various methods to mess this up. Although I’ve written elsewhere about why I like this sector, at the moment I need to speak about how this might go incorrect.

I’m going to offer you a quick tour of my 4 brushes with manufactured housing investing with the hope that you could keep away from my errors and benefit from the superior advantages of this highly effective asset class. Then, I’ll inform you why I like cellular house parks.

Expertise 1: Pure Ignorance

My mama all the time instructed me to avoid trailer parks. Did yours?

She instructed me nothing good occurs there. I feel I even heard her use the phrase “trailer trash.” (I’m not happy with that.)

My pricey mom and father handed away a number of years in the past. And after a lifetime of working arduous at a well-paying job, Dad left us about sufficient cash to cowl their funerals—together with some hefty bank card payments.

I’m grateful for the life they gave me. However my mother and father weren’t nice traders. In truth, they knew nothing about investing. And this was a handicap to me—particularly once I made my first few million {dollars} at age 33.

I knew nothing about investing. And in consequence, I confused investing with speculating. I launched into a number of years of binge-speculating (although I instructed folks I used to be “an investor”). And it price me dearly.

I truly had an opportunity to spend money on a cellular house park again in these days. I swiftly turned my nostril up at that chance. And I can think about that you simply might need the identical response.

Although I don’t know if I’d have had the humility to hear in my mid-thirties, I want I’d have had entry to the knowledge of Robert Helms from The Actual Property Guys. Robert stated, “Reside the place you need… and make investments the place it is sensible.”

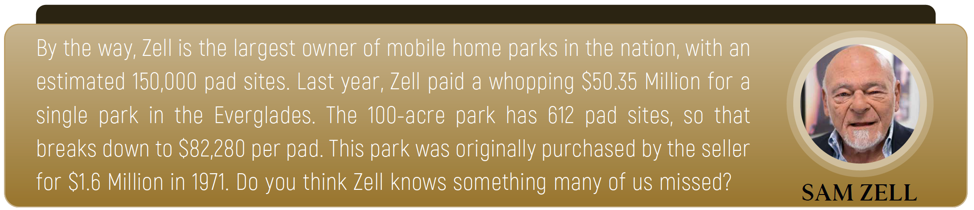

Please don’t ignore this highly effective asset class. Warren Buffett and Sam Zell, two of the highest traders of all time, can’t be incorrect.

A Wall Street Journal article revealed just some weeks in the past particulars how Sam Zell’s inventory grew at over 1,200% for the reason that recession, and one other cellular house park firm, Solar Communities, truly grew at 4,100%. (I just like the subtitle. See beneath.)

Expertise 2: Investing in Particular person Cell Properties

I can’t inform you how badly this went for me. Once I look again on my years of actual property investing and consider my worst errors, three cellular house investments prime the listing. These had been a few of the impetus for co-launching our The way to Lose Cash podcast over three years in the past.

Although there are exceptions, trailer tenants are a few of the tougher tenants on the market. Each single cellular house park investor I do know avoids proudly owning particular person cellular properties. There isn’t a finish to the tales I may inform you from my experiences. And I hear the identical factor from prime business professionals.

Proudly owning and renting out cellular properties makes a ton of sense on paper, however that’s the place it stops. Don’t be fooled into believing in any other case.

Virtually all profitable cellular house park traders personal and function the dust and infrastructure of the park. And that’s the way in which they need to hold it. After they “inherit” an deserted trailer or purchase a park-owned house with a park acquisition, most need to promote it to the tenants as rapidly as potential.

And because of our buddy Warren Buffett and Berkshire Hathaway’s twenty first Mortgage Company, it’s simpler than ever to get financing for tenants who need to make these rented properties into owned properties. The boundless enthusiasm of the nation’s prime actual property investor, Sam Zell, has made financing extra broadly accessible, as effectively.

Cell properties are additionally the one asset (to my data) that may be financed for buy via Part 8. Do you know that?

Associated: The Investor’s Guide to Mobile Home Licenses

Expertise 3: Constructing Modular Properties

Manufactured housing falls into at the very least three classes:

- Cell properties

- Leisure automobiles (RVs)

- Modular properties

I’m truly a fan of the final class. Modular properties are properties which can be constructed to stick-built (site-constructed) requirements, however they’re pre-assembled in factories and arrange onsite. There are lots of benefits to such a building.

This was particularly advantageous to an actual property investor (me) who didn’t have a building background. It restricted my threat, time, and trouble in developing new properties. And I constructed about seven of those within the early a part of the century (I nonetheless love saying that). I made cash on each (contrasting with dropping tens of 1000’s on one of many two ground-up building properties I constructed).

I hear your query coming: “Wait. So why was this a mistake?”

Typically investments don’t need to lose cash to be a mistake. If I instructed you I used to be “investing” in my financial savings account at underneath 1% curiosity, would you name {that a} mistake proper now? I hope so.

The modular house saga included a variety of drama and trouble, and it was by no means as worthwhile as predicted on paper. And most significantly, in comparison with the place I’m now, I wasn’t constructing actual wealth. I used to be simply buying and selling hours and energy for {dollars}. And I wasn’t acquiring the highly effective tax-saving methods accessible to industrial actual property traders.

Expertise 4: Passively Investing

My agency, joined by a rising tribe of pals and traders, vets best-in-class operators within the cellular house (and self-storage) house and invests closely with them. And we couldn’t be happier. We’re having fun with the fruits of a beautiful asset class with out the trouble and threat of working the property ourselves. That is my favourite investing technique.

Why Cell Residence Parks?

I’ve already written about this, and I’ll accomplish that once more quickly. Here’s a listing of why we love this asset class:

- Recession-resistant (regular via the final downturn)

- Shrinking provide, rising demand

- Tenants that not often depart

- Low and predictable upkeep and capital bills

- Restricted want for contractors

- Tenants are joint stakeholders with park house owners

- Stigma of cellular house park investing results in decrease competitors

- Nice financing choices

- Stunning tax advantages

- Mother-and-pop house owners ageing out and promoting underperforming properties

- Hungry institutional traders who need to write giant checks (the advantage of assembling a stabilized portfolio)

Are you able to spend money on cellular house parks?

Our personal Brandon Turner has joined Sam Zell and Warren Buffett to construct his future round this highly effective asset class. If you wish to study extra, look out for the brand new e book I’m writing on self-storage investing to be revealed by BiggerPockets.

Associated: 10 Tips for New Mobile Home Investors From Active Mobile Home Investors

Have you ever let the trailer park stigma hold you out of this recession-resistant asset class or are you all-in on cellular house parks?

Tell us your opinion within the feedback.