When the Astor Place Starbucks closed in 2024 after practically 30 years, it left a gap in a busy East Village industrial strip — and within the pocket of the Gindi household.

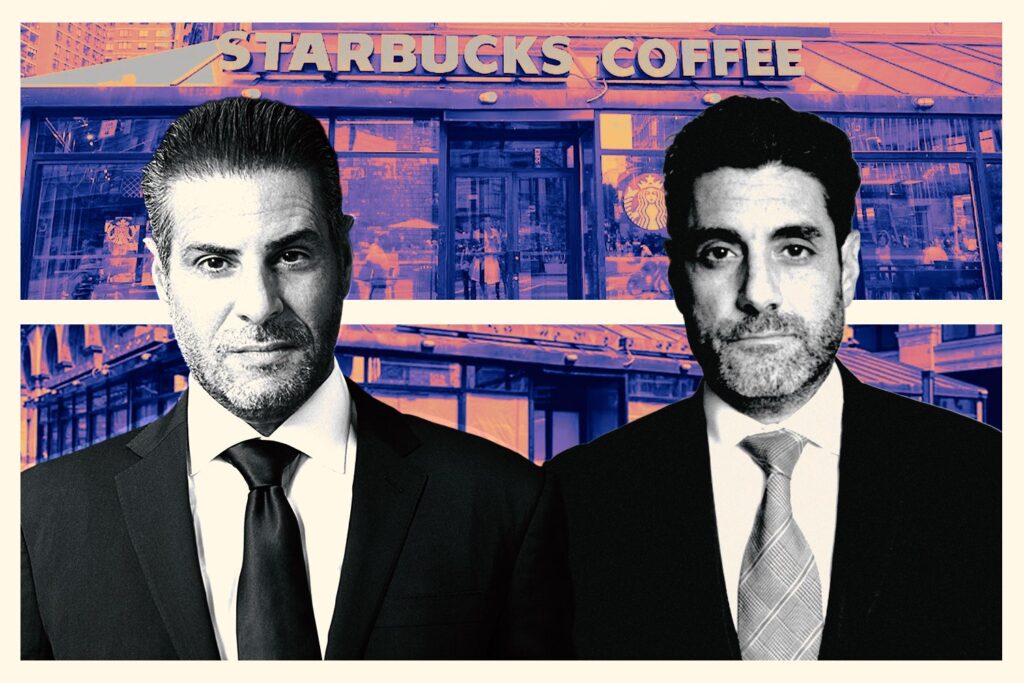

The worth of the industrial rental at 21 Astor Place has dropped 72 p.c in a decade, from $42 million to $11.7 million, in keeping with Morningstar Credit score. The proprietor, an entity related to Isaac and Edward Gindi, is presently battling foreclosure.

An organization now related to the Gindis purchased the industrial rental for $13 million in 2004, in keeping with metropolis information. Possession pursuits seem to have transferred a number of occasions, however in 2015, Isaac and Edward sponsored a $26.65 million refinancing mortgage for the placement.

Hassle started just a few years later in 2021, when FedEx vacated greater than 60 p.c of its house within the industrial rental, which extends across the south facet of the constructing on Astor Place. Income fell by about 40 p.c from 2020 to 2021, in keeping with info from Morningstar.

DoorDash moved in swiftly to occupy the 6,000-square-foot house, lured by 90 days of free lease. That stored the property full, however rents have been nonetheless decrease than their peak, in keeping with the mortgage servicer.

Starbucks had signed a 20-year lease for simply over 4,000 sq. ft on the rental, throughout the road from the “Dice” sculpture, in 2004. The positioning rapidly turned a case examine for the world’s altering demographics.

“East Village grit is giving technique to Midtown-style blandness,” The Actual Deal wrote in 2007, when Starbucks renewed one other lease down the road.

However the espresso chain closed the Astor Place location final 12 months.

“It was a gentrifier that the neighborhood grew to just accept fairly rapidly,” Curbed eulogized after the announcement. “It discovered its viewers in one million NYU-freshman-year examine dates.”

The withdrawal of Starbucks triggered a requirement for the borrower to deposit $1.5 million within the lender’s account, one thing it didn’t do, the lender alleges in a July foreclosures go well with. The Gindis, who served as restricted guarantors on the mortgage, allegedly didn’t submit documentation about their internet value and liquidity.

“The emptiness at 21 Astor stems from excessive taxes, advanced landmark laws and prolonged municipal approvals,” Terrance and Darren Oved, the Gindis’ counsel of Oved & Oved LLP, mentioned in a press release. “Our shopper is actively addressing these challenges and stays assured in securing an appropriate tenant for the house and the neighborhood.”

The courtroom appointed a short lived receiver to the property on Friday.

Learn extra

Gindis face potential foreclosure on former Astor Place Starbucks site

Attention Kmart shoppers: Last Manhattan store is closed