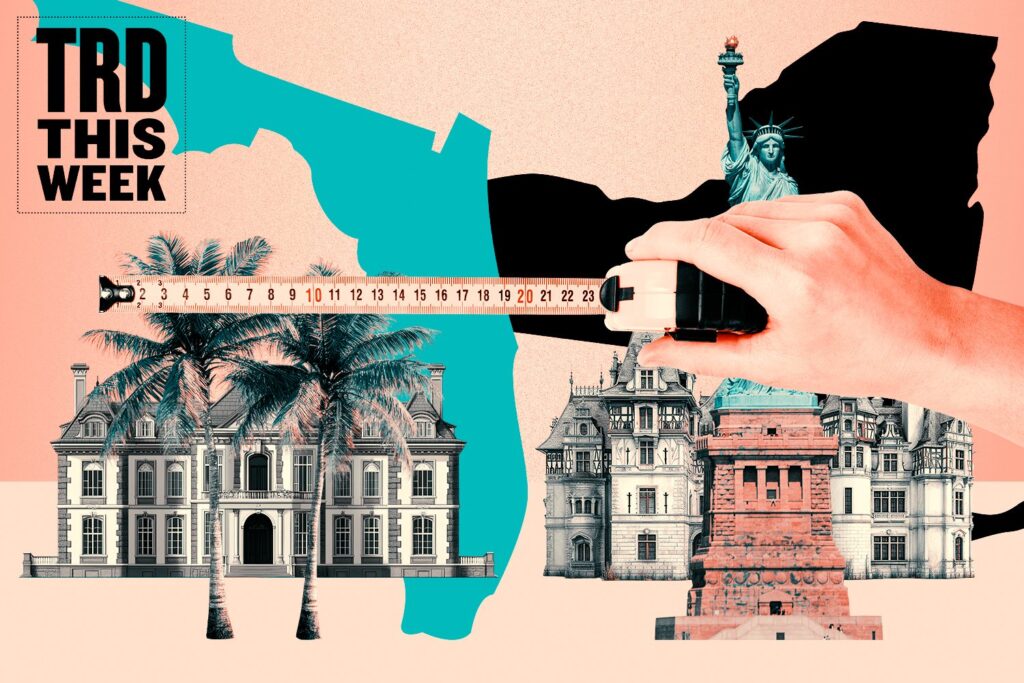

The final decade has seen New York Metropolis’s luxurious market overtaken by its greatest rivals.

A report from Redfin exhibits how the Massive Apple’s market has stood stagnant within the final decade as costs within the Solar Belt and South Florida surged.

Between October 2015 and October 2025, luxurious residence costs in New York have hardly budged, rising simply 15 p.c in the identical time interval to $4.1 million. The market notched the smallest development amongst main metropolitan areas, adopted by Houston with over 49 p.c luxurious worth development.

On the leaderboard had been West Palm Seashore and Miami, the place costs grew by over 187 p.c and 148 p.c to hit simply over $4 million and $4.3 million, respectively.

The Sunshine State’s ascent among the many nation’s prime luxurious markets has been well-documented, driving a wealth migration sparked first by the 2017 tax regulation modifications and exacerbated throughout the pandemic supported a wave of exercise and a growth in new improvement.

“The luxurious market has expanded far past its conventional boundaries,” Redfin’s Head of Financial Analysis, Chen Zhao, mentioned in a press release. “The priciest houses was once extra concentrated in a smaller variety of East and West Coast metros. Immediately, high-end wealth is more and more distributed throughout the Solar Belt — from Florida to Texas to Arizona.”

The discrepancy in development charges could possibly be an indication that the posh market throughout the 5 boroughs is simply extra mature — it didn’t have the identical development potential as a result of costs had already hit an affordable ceiling.

However different metrics included within the report point out that market maturity isn’t the one rationalization. Within the platform’s rankings of luxurious markets, New York fell from No. 2 in 2015 to No. 6 in 2025, slipping behind San Francisco, which claimed the highest spot in each years, Los Angeles and Miami.

“New York’s luxurious housing market was already cooling earlier than the pandemic as new taxes on high-priced houses and a flood of latest rental developments tempered demand,” the report explains. “When the pandemic hit, that slowdown deepened as rich patrons fled the town for bigger suburban or Solar Belt houses and international funding dried up.”

Regardless of its 10-year downward development, the town could possibly be preparing for a rebound, if final month’s deal costs are any indication. Luxurious residence costs rose 10 p.c in October in comparison with the identical month final 12 months.

Not so quick…

Alexander Zakharin, a broker and real estate content creator, is the most recent addition to a workforce at Ryan Serhant’s eponymous brokerage.

Zakharin, who counts roughly 1 million followers throughout his Instagram, TikTok and YouTube accounts, has joined a workforce led by Nile Lundgren, a dealer who was featured on the primary season of Netflix’s “Proudly owning Manhattan.”

Earlier than teaming up with Lundgren, Zakharin was an agent with Compass for simply six months after a two-and-a-half-year stint with Nest Seekers, the brokerage the place Serhant started his actual property profession.

Lundgren is bringing on a brand new workforce member simply in time for the premiere of the second season of “Proudly owning Manhattan,” which follows Serhant and brokers along with his agency. The present’s eight episodes can be out there beginning Friday, Dec. 5.

Earlier this month, the streaming service launched a sneak peek of the season, which featured a brand new solid member, Serhant’s Peter Zaitzeff, who heads gross sales at a few of the metropolis’s buzziest new developments akin to Naftali’s Williamsburg Wharf. Previously with Corcoran, Zaitzeff was additionally certainly one of brokers behind a $60 million deal for a penthouse at 150 Charles, which set the document for the most costly rental ever bought in Downtown Manhattan.

Inside a New York courtroom…

Disgraced brokers Tal and Oren Alexander and their brother, Alon Alexander, had been again in a New York federal courtroom this week, forward of their intercourse trafficking trial set to start in January.

Their look got here days after prosecutors dropped a fourth indictment towards the trio, including a brand new cost accusing Oren of sexually exploiting a minor in 2009. In complete, the federal government has introduced 11 fees towards a number of of the brothers.

The newest indictment additionally broadened the scope of the conspiracy cost. Prosecutors now declare the alleged “intercourse trafficking scheme” stretched from 2008 to 2021, pushing the beginning date again by a 12 months.

Protection attorneys on Monday pushed again towards the federal government’s proposed witness checklist, which included 17 alleged victims whose accounts don’t type the premise of standalone fees however would as an alternative be used to assist the conspiracy rely or a historical past of alleged sexual assault.

Two of these victims had been taken off the checklist, and United States District Decide Valerie E. Caproni mentioned that whereas prosecutors can select easy methods to pare down their case, she gained’t enable the entire remaining witnesses to take the stand throughout the trial.

The brothers are due again in court docket on Tuesday, when Caproni will hear arguments over whether or not the newly added cost towards Oren must be separated from the remainder — a response to the protection’s argument that it got here too near trial — and the inclusion of sure knowledgeable witnesses.

Learn extra

Development

South Florida

The Weekly Dirt: Mamdani effect takes center stage in Miami

Residential

South Florida

Palm Beach County luxury contracts surge post-Mamdani win

Manhattan’s luxury deals thrive following NYC mayoral election