The Meadows is dealing with a drought.

The workplace complicated in Rutherford, New Jersey, has taken a 30 % valuation minimize within the final decade — from $128 million to $90 million, based on Morningstar Credit score. The property entered particular servicing in Might and the servicer mentioned it not too long ago initiated the foreclosures course of.

The proprietor, business actual property funding agency American Landmark Properties, has requested a modification of the mortgage, based on data offered to Morningstar.

The workplace market in north and central New Jersey hasn’t recovered from its pandemic-era dive as companies embrace hybrid work and pursue Class A space.

American Landmark bought the two-building complicated at 201 Route 17 North for $125.2 million in 2015, based on the agency’s web site. The corporate took out a senior mortgage for $92 million from LCF and $12 million in mezzanine debt from Harbor Group Worldwide, based on Morningstar. The senior mortgage matured in September.

However by 2018, the complicated’s largest tenant, Malo Consulting, had defaulted on its lease. Malo, which operated a medical facility on the workplace complicated, had taken up about 12 % of the leasable space. That put the Meadows on its servicer’s watchlist.

Then income dipped precipitously through the pandemic — from $16.6 million when the mortgage was written to simply $11.9 million in 2020, based on Morningstar Credit score. Issues picked again up however by 2024 numbers had been trending within the improper route. Occupancy fell to 83 % that 12 months as web working revenue dropped to $7.2 million from $8.6 % 9 years earlier.

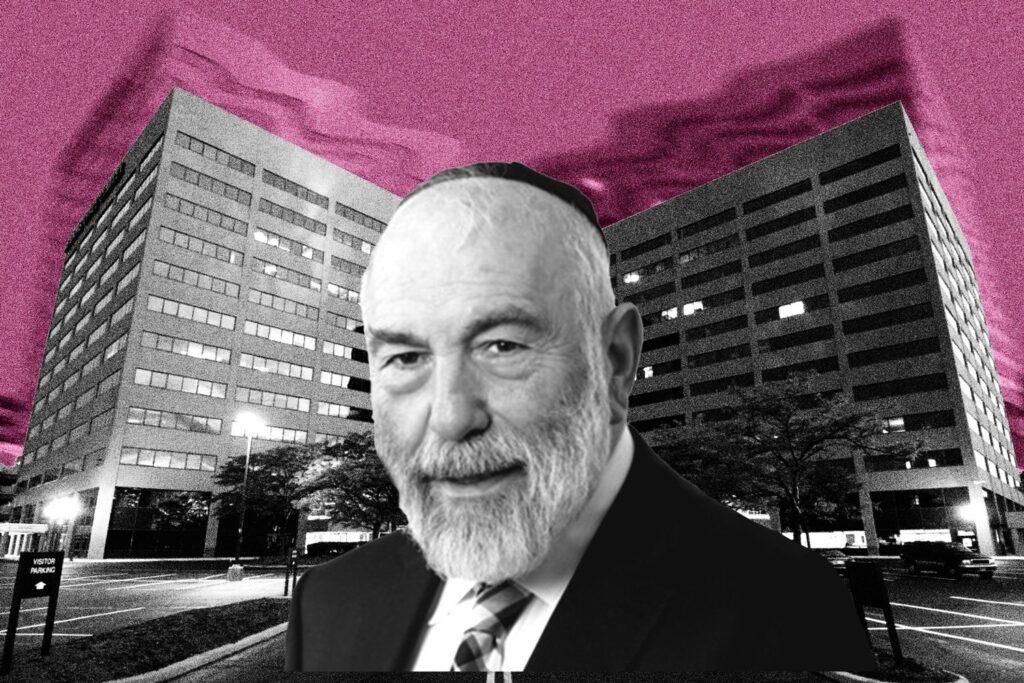

American Landmark focuses totally on workplace investments, and owned Chicago’s Willis Tower from 2004 to 2015. Yisroel Gluck, a principal at American Landmark who’s listed because the sponsor of the mortgage, didn’t instantly reply to a request for remark.

Most not too long ago, the workplace complicated is occupied by a number of smaller companies, with none leasing greater than 9 % of the whole space. The most important tenant, based on Morningstar, is the American arm of Japanese cosmetics firm Shiseido, which owns its titular model, in addition to NARS and Drunk Elephant.

Different main tenants embody United Healthcare Service and the headquarters of tutoring chain Kumon. The workplace area is close by the Meadowlands Sports activities Advanced, house to the Giants and Jets and the American Dream mall, the debt-laden megamall idea by the Ghermezian family’s Triple Five Group.

The workplace market in north and central New Jersey has slowed in recent times, based on a report from Colliers Worldwide. The emptiness price within the area has ticked up because the starting of 2022, and presently stands at about 25 %. The excessive availability is predicted to stay, though 2025 might even see the sector’s first optimistic web absorption since 2019, Colliers analysts wrote.

Learn extra

Ghermezians extend Mall of America’s $1.4B mortgage

American Dream owners secure a win with $850M valuation chop

American Landmark Properties auctions last piece of bioscience redev