The mismatch stems from the way in which COLAs are calculated. At present, the SSA bases annual will increase on the Client Worth Index for City Wage Earners and Clerical Employees (CPI-W), a measure designed across the spending habits of youthful, city employees.

Another measure, the Client Worth Index for the Aged (CPI-E) weights housing, well being care and utilities extra closely and would have produced a 3.1% improve in 2026 as a substitute of two.8%, in response to Investopedia.

COLAs primarily based on the CPI-W have lagged behind the CPI-E in every of the previous three years — and in 18 of the previous 26 years, by a median of 0.2% yearly. This has meant that retirees’ annual raises haven’t at all times stored tempo with the inflation of their commonest bills.

Even with a change to the CPI-E system, rising Medicare costs might offset some good points, Newsweek reported. Medicare Half B premiums, that are set to rise from the present degree of $185 to $202.90 in 2026, proceed to eat into COLA good points and outpace profit will increase.

Social Security advantages have more and more lagged behind inflation. Whereas 60% of cost-of-living changes outpaced inflation within the Nineties and 2000s, that fell to 40% within the 2010s and solely 20% within the early 2020s — aside from the 8.7% improve in 2023 pushed by pandemic-era inflation.

The Senior Residents League (TSCL) studies that retirees who began advantages in 1999 have misplaced almost $5,000 in lifetime funds in contrast with what they might have obtained beneath CPI-E. For these retiring in 2024, the shortfall might exceed $12,000 over a 25-year retirement.

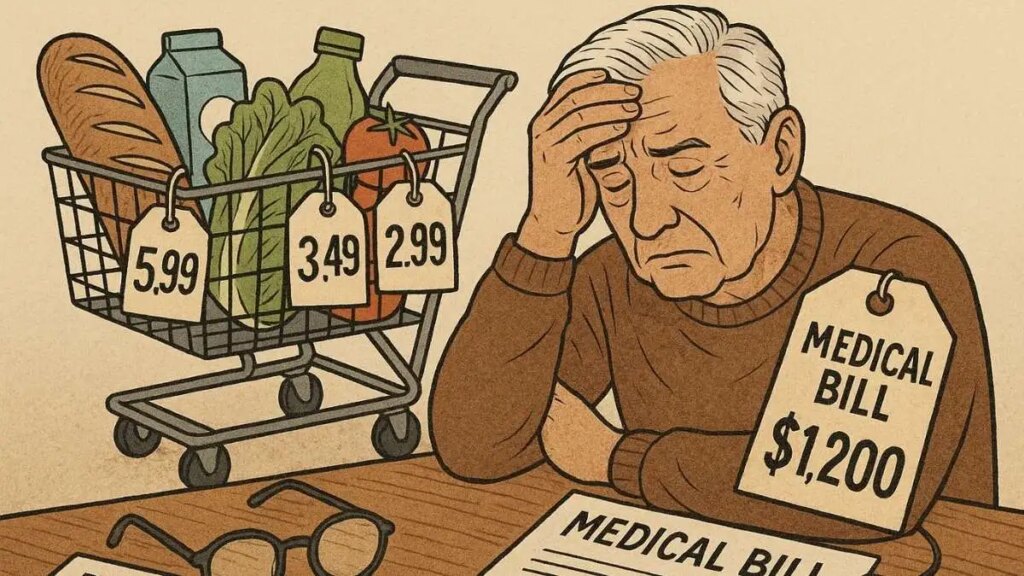

TSCL additionally estimates that Social Safety advantages have misplaced roughly 20% of their worth since 2010. To completely restore their buying energy, retirees would wish a further $370 monthly, or $4,440 yearly.

Congress has launched two payments aimed toward addressing the hole as any change to how the COLA is calculated would require a change in federal regulation.

The Boosting Benefits and COLAs for Seniors Act would overhaul how annual changes are calculated, whereas the Social Security Emergency Inflation Relief Act would briefly add $200 monthly to advantages till July 2026.

In accordance with Newsweek, each proposals are backed by Democratic Sens. Elizabeth Warren, Kirsten Gillibrand, Ron Wyden and Chuck Schumer, amongst others.