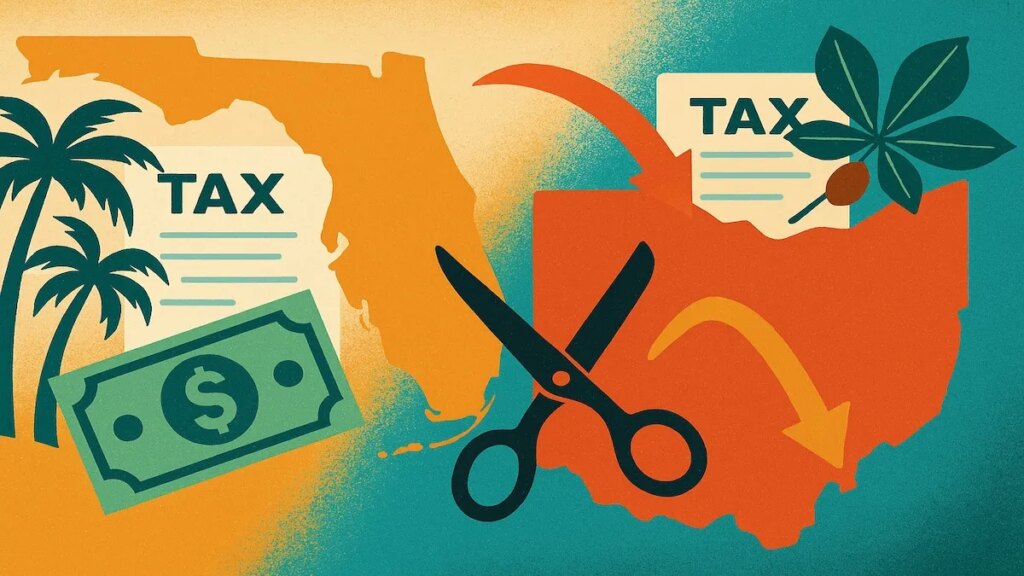

In Florida, Home Republicans superior a slate of non-school property tax reductions by way of preliminary committees final week, together with measures that might wipe out such taxes outright or part them out over 10 years.

A separate invoice would eradicate non-school property taxes just for residents 65 and older.

“This can be a focused method to assist those that want it probably the most,” Miami Republican Rep. Juan Porras advised native outlet Spectrum News 13. “Our most susceptible communities, those that have constructed the cities and counties, the areas that all of us symbolize.”

One other proposal would lock in legislation enforcement funding by mandating police budgets stay untouched.

If permitted by the Legislature, the constitutional amendments would head to Florida voters in 2026, the place they would want 60% assist.

Democrats warned of steep penalties for cities and counties that rely closely on property taxes.

The Florida Coverage Institute estimates a $43 billion hole in funding wanted to keep up providers below the Home proposals.

“We shouldn’t be placing our native governments in a state of affairs the place we’re taking away instruments, solely to have them shift that burden in another method,” stated Home Democratic Chief Fentrice Driskell. “That’s really going to have probably the most adversarial impacts on the individuals who want our assist probably the most.”

The Florida Senate has filed no companion payments, and Gov. Ron DeSantis has criticized putting a number of tax amendments on the 2026 poll, calling it a flawed method, Spectrum Information 13 added.

Florida’s property tax burden has shifted strongly towards residential property homeowners over the past three a long time.

State knowledge reveals that residential parcels now account for greater than 70% of property taxes levied statewide — up from a a lot smaller share in earlier a long time.

5 payments head to Ohio Governor’s desk

Ohio Gov. Mike DeWine is reviewing 5 sweeping property tax payments the GOP-led Legislature permitted in fast succession, which follows an extended timeline of public feedback on the matter.

Proposals comply with DeWine’s earlier vetoes of tax modifications within the state finances — vetoes lawmakers initially vowed to override earlier than backing down after one override involving substitute and emergency levies.

The measures would let county officers cut back beforehand voter-approved levies, prohibit tax invoice progress to the speed of inflation, develop alternatives for reductions and shift the burden of proof in valuation disputes.

“Our taxpayers, whom we symbolize, need property tax aid,” Republican Sen. Sandra O’Brien advised Ohio Capital Journal. “The payments that we’re about to vote on provide them that aid.”

She additionally warned of a separate poll effort to eradicate property taxes solely — arguing that situation, if profitable, would “place Ohio on the fringe of the abyss.”

DeWine stated Friday he’ll consider the payments primarily based on suggestions from a property tax working group he convened.

That group reportedly weighs funding wants for faculties and native providers in opposition to householders’ rising prices and affords steerage on a number of measures — together with millage caps and defining when voted levies could also be diminished.

“So, I’ll decide these payments primarily based upon what the committee got here up with,” DeWine stated. “In a couple of days, we’ll have some feedback about that.”

Over the previous 30 years, state coverage modifications have shifted extra of the tax burden onto Ohio’s residential property homeowners and away from companies.

Ohio’s residential {dollars} rose from representing a mid-50% vary of the overall property tax pool in 1999 to the high-60% to low-70% vary by the 2010s and into the 2020s, based on state knowledge.