The dialog across the horrific misdeeds of Jeffrey Epstein seems to be neverending as extra revelations proceed to drip out, together with his connection to actual property. Extra on that in a bit.

However in enterprise information there was a deal this week you in all probability gained’t examine at ebook gala’s throughout the nation.

Tony Malkin’s Empire State Realty Belief is in contract to purchase the Scholastic Constructing in Soho for $386 million, the corporate introduced Tuesday.

The writer owns the constructing at 555-557 Broadway and leases the vast majority of the area, which incorporates 368,000 sq. ft of workplace and 28,000 sq. ft of retail alongside Soho’s prime purchasing hall.

Malkin mentioned he was drawn to the property for its in-place income and the flexibility so as to add worth by advertising the “three uniquely giant flooring in a greater than 110,000 sq. ft block.”

Scholastic put the property up for sale earlier this year, eyeing a sale-leaseback deal. The general public firm reportedly deliberate to make use of the proceeds from the sale for “capital allocation priorities,” decreasing its debt and repurchasing shares.

The corporate purchased the property in 2014 for $255 million from South Carolina-based landlord ISE America, which had since 1996.

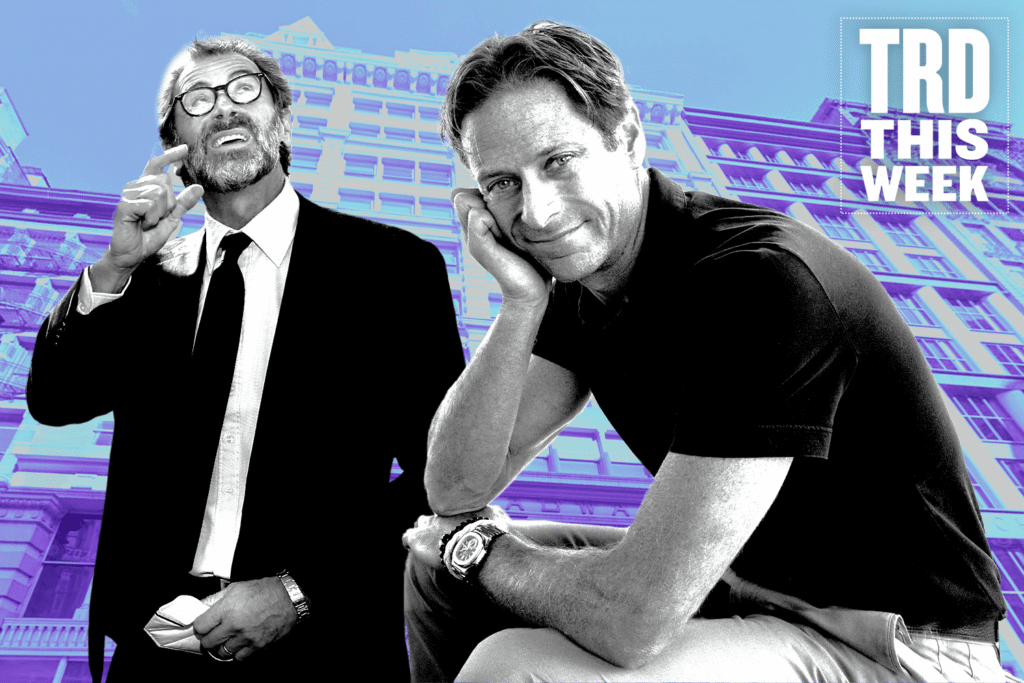

Billy Macklowe’s profession hasn’t at all times been educational, however his bets are by no means uninteresting. He lately accomplished development of a mixed-use development in Park Slope, his first Brooklyn growth and in addition developed a 52-unit apartment constructing at 21 East 12th Street.

Subsequent up? His William Macklowe Firm acquired the $46 million distressed mortgage be aware on the 129,000-square-foot, 10-story workplace constructing at 291 Broadway from Flagstar Financial institution.

The sale occurred after Flagstar sued the proprietor, Sutton Administration, for foreclosures in July due to missed funds.

The constructing could possibly be a candidate for a residential conversion if Macklowe forecloses or takes a deed-in-lieu.

Conversions are at all times a raffle. So is playing. Fortunately for cube rollers, the endgame for New York’s gaming enterprise is coming into focus.

The state Gaming Facility Location Board recommended on line casino licenses for the three remaining proposals in Queens and the Bronx: Steve Cohen’s Metropolitan Park, Bally’s Golf Hyperlinks at Ferry Level and Resorts World’s growth of the Queens Aqueduct.

The extent of funding for every bid dictates the license time period: Metropolitan Park and Resorts World qualify for 20-year licenses, whereas Bally’s qualifies for a 15-year license.

The proposals, which included plans for lodges, leisure venues and a deal with “financial exercise and enterprise growth,” subsequent go to the Gaming Fee for last license issuance. That’s anticipated to occur by the top of the month.

Sure, casinos are in a New York frame of mind. Nas, famed rapper and Resorts World accomplice mentioned it finest after the suggestions have been launched: “It’s a terrific day in New York Metropolis.”

Lastly, the Epstein connection to actual property.

The late and disgraced financier privately claimed in 2018 to have “helped put them in biz,” and by “them” he meant Core Membership founders Jennie and Dangene Enterprise, an allegation a spokesperson publicly refuted as “baseless.”

Emails launched by the Home Committee — a 20,000-page trove of paperwork — recommend a private relationship between Epstein and Jennie Enterprise.

The invite-only Core Membership caters to highly effective clientele in actual property and finance, together with figures like RFR’s Aby Rosen and Blackstone CEO Stephen Schwarzman.

“[I]n no approach, form, or type did this particular person play any enterprise growth position within the firm, and any suggestion on the contrary is baseless,” mentioned a spokesperson for Core Membership.

Epstein, because it seems, was additionally a reader of The Real Deal. Whereas his curiosity in our publication is on no account a degree of pleasure, launched paperwork revealed emails with hyperlinks to TRD articles, which seems to be a saved or printed internet story from June 2019. The emails and articles touched on a Palm Seaside growth deal.

Learn extra

State signs off on three casinos for NYC

Billy Macklowe buys $46M note on Tribeca office building

Jeffrey Epstein on Core Club founders: “I helped put them in biz”