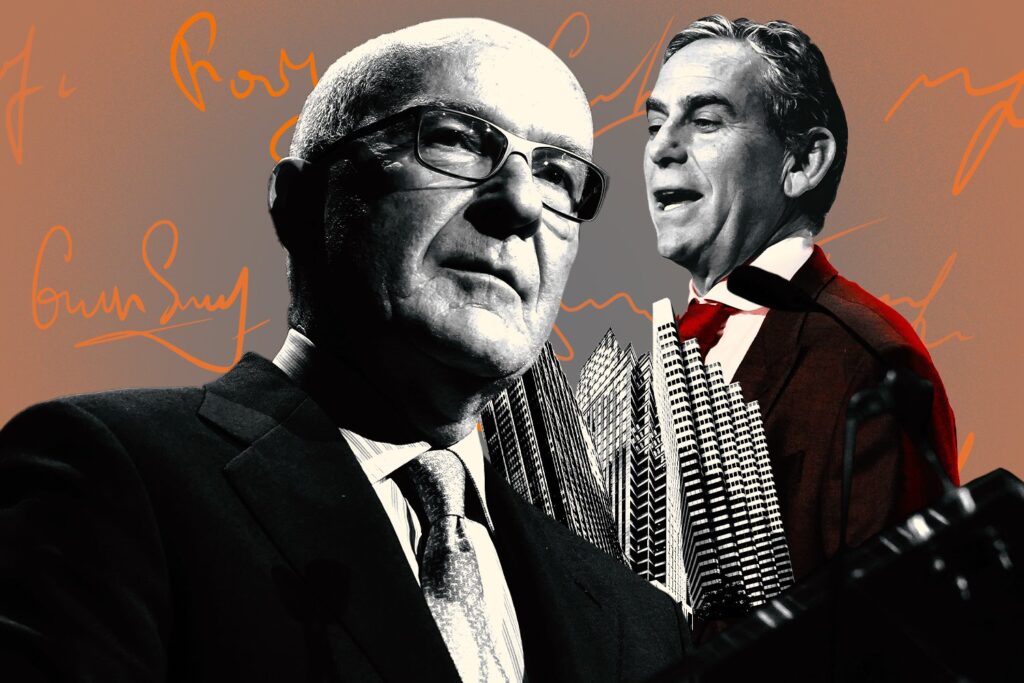

Paramount Group is one step nearer to being bought and Albert Behler is one step nearer to receiving his golden parachute, whether or not his shareholders need him to have it or not.

This week, Paramount’s shareholders accepted the actual property funding belief’s sale to Rithm Capital, Crain’s reported. The Manhattan-based purchaser submitted a $1.6 billion bid for the acquisition in September, which was $6.60 per share, 11 p.c under market worth.

Saray Capital, a Dubai-based funding agency with a small stake in Paramount, swooped on this month with a suggestion of $6.95 per share, based on a regulatory submitting. However Paramount’s board beneficial the Rithm provide resulting from “materials deficiencies” in Saray’s provide, together with a dearth of dedicated financing.

In one other notable vote by shareholders, a overwhelming majority rejected Behler’s $34 million exit package, deemed unwarranted by a proxy adviser forward of the vote.

Sadly for these shareholders, the vote was not binding and Paramount revealed in a regulatory submitting that Behler will seemingly get his golden parachute so long as a sale goes via. Behler’s compensation will embrace $10.7 million in money, $19.97 million in unvested fairness awards and $3.3 million in different compensation.

Behler has been the CEO of Paramount since 1991. He led Paramount via its $2.3 billion preliminary public providing in 2014, which was the most important IPO for a U.S. REIT on the time.

He’s been a controversial determine recently, nevertheless. This yr, Paramount revealed it paid hundreds of thousands to Behler’s private firms and pursuits. The beforehand undisclosed funds included $3 million to a non-public jet firm — of which Behler had a 50 p.c stake — and $900,000 for Behler’s private accounting companies.

In July, Paramount revealed it was underneath SEC investigation associated to disclosures for related-party transactions, conflicts of curiosity and govt compensation.

The Actual Deal additionally found Behler pushed for a no-bid safety contract for 60 Wall Avenue, a 1.6 million-square-foot vacant workplace constructing, to Guardian Companies. Behler’s ex-girlfriend labored at Guardian and the 2 maintained pleasant relations after their romantic relationship ended.

The sale of Paramount is anticipated to shut by the tip of the second quarter. Paramount controls 13 million sq. ft of workplace house in New York and San Francisco.

Learn extra

Paramount Group CEO’s golden parachute could net him $34M

Rithm Capital inks deal to buy Paramount for $1.6B

Paramount lands $175M refi for 900 Third Ave