Nobody noticed it coming. Nobody might have predicted it. It’s loopy to suppose that an an infection that began with one or two folks on the opposite facet of the globe has introduced all the world to its knees.

And this factor is way from over. Everyone knows that.

However take into account that disaster is indisputably the best possible place for good entrepreneurs and traders to create wealth like by no means earlier than.

Creating Wealth in a Time of Disaster

Joseph Kennedy, Bill Gates, and Steve Jobs created their corporations in instances of disaster. And also you could be a hero too if you happen to place your self NOW to capitalize on alternatives within the coming months and years.

Do you know that Warren Buffett made a fortune buying financial stocks in the midst of the financial panic in the fall of 2008? He’s recognized for his saying: “Be fearful when others are grasping, and be grasping when others are fearful.”

Buffett additionally mentioned, when discussing going in opposition to the group:

“You pay a really excessive value within the inventory marketplace for a cheery consensus.”

Legendary investor, Howard Marks, of Oaktree Capital was shopping for monetary shares in Fall 2008, too. A reporter interviewing Marks requested about what he was promoting. He knowledgeable her that he was shopping for monetary shares to the tune of half a billion per week—as a lot as he might get his fingers on.

She appeared perplexed, to which Marks mentioned, “If not now… when?”

(By the way in which, have you ever taken my repeated recommendation and skim the great Howard Marks guide referred to as Mastering the Market Cycle: Getting the Odds on Your Side? You can purchase that proper now. Then purchase and skim my buddy Brian Burke’s new guide on due diligence and passive investing referred to as The Hands-Off Investor by BiggerPockets Publishing—however I digress.)

Marks and Buffett repeatedly discuss in regards to the idea of catching a falling knife.

You see, it’s straightforward to select up a pointy knife from the kitchen flooring with out being reduce. Even a toddler can try this effectively.

However the true ability is in studying to catch a falling knife. It takes ability, focus, and nerves of metal. But when you are able to do it effectively, as Buffett and Marks did within the Nice Recession, you can be positioned to make your self and your traders a whole lot of revenue and wealth.

Marks says that to do this right, you don’t want to wait until the panic is over. Don’t wait till the mud settles, and the world is on the way in which again to regular. Don’t wait till folks take a deep breath and see the sunshine on the finish of the tunnel.

He says you might want to pull the set off when issues look worst—when gloom and doom abound and when pundits are saying, “The world as we all know it’s over.”

(Sound acquainted?)

Although I don’t just like the imagery, British nobleman Baron Rothschild reportedly said…

“Purchase when there’s blood within the streets, even when the blood is your personal.”

So, for sure, I’m an enormous advocate of shopping for actual property in a down market. Whereas Marks’ knife is falling, and pessimism is at its top.

However I’ve a thought on the best way to play this card even higher.

Associated: Recession Prep 101: Investing in Real Estate During a Financial Crisis

Property That Do Nicely in Any Market

What if you happen to might spend money on actual property asset varieties that carry out effectively in a terrific market… and in a recession, as effectively?

What if you happen to might spend money on or purchase property that profit from a level of unwarranted panic-selling—and pay a particularly reasonable value to accumulate them from mom-and-pop operators who had been about able to retire anyway?

2 Varieties of Investments Nicely Value Your Consideration

The opposite day I used to be listening to a Crowdstreet webinar on the devastating effects of the coronavirus crisis to real estate markets.

(Please don’t hear until you need to be depressed. It was filled with doom and gloom, and actually, it was unnerving to listen to how unhealthy issues actually are in so many sectors.)

About 44 minutes in, nonetheless, the skilled panel took on a brighter tone. They mentioned, in essence, that they needed to show to 2 asset varieties that had been truly performing effectively prior to now month—within the face of the devastating inventory market curler coaster and actual property volatility amongst different asset varieties.

Are you able to guess what they’re?

Self-Storage and Cellular Residence Parks

They went on to say that…

“As we all know, self-storage could be a counter-cyclical asset… Inside the trade, they discuss in regards to the 4Ds. We’ve obtained downsizing, divorce, dislocation, and sadly dying. These are actual issues, and that is the place the self-storage market sits and the wants that it serves…. subsequently, it places self-storage into a comparatively great spot from an asset class perspective.

“Arguably proper now [manufactured housing] is the darling of the commercial real estate industry. You already know, if there may be one factor which you could take a look at when it comes to eager to see the vanguard of the place we’re, go take a look at the general public CRE markets, proper? You’ve obtained hospitality REITs which might be getting wacked 40 to 50 p.c… They [manufactured housing] are constructive as a result of there was no provide. It’s essentially the most inexpensive type of housing in america and the NIMBY-ism (not-in-my-backyardism) mainly makes these things tough to acquire.”

What Makes Self-Storage and Cellular Residence Parks Recession-Proof Investments?

So, it’s possible you’ll be asking… WHY? What’s so nice about these two asset courses?

I’m glad you requested.

Why I Love Investing in Cellular Residence Parks

Cellular residence parks have been referred to as “the darling of all business actual property.” That’s a fairly large label contemplating this asset class was mainly laughed at just a few years in the past.

However actual property’s most profitable investor, Sam Zell, was laughing, too… all the way in which to the financial institution.

Right here’s a fast checklist of what I really like about this ignored asset class:

- Recession resistant: Regular in all cycles

- Shrinking provide: Distinctive asset class

- Reasonably priced housing disaster: Equates to elevated demand

- Excessive switching prices: Equates to low tenant turnover

- Fragmentation: Mother-and-pop house owners

- Diminished prices: Low upkeep & capital bills

- Much less competitors: Stigma of cellular properties

- Portfolio alternative: REITs seeking to purchase stabilized property from us

Why I Love Investing in Self-Storage

I simply spoke to our working accomplice who we make investments closely with. He knowledgeable me that he’s renting self-storage at report charges in sure areas.

(That is in every week the place resorts, airways, retail, and eating places are sucking wind like by no means earlier than.)

Why?

He mentioned that the 4 Ds—downsizing, divorce, dislocation, and dying—are inflicting elevated rental exercise. And his amenities close to faculties are getting an inflow of scholars who’re heading residence for the 12 months… or completely. They’re leasing on-line and going straight to their models whereas holding their social distancing intact.

Wow.

Self-storage REITs are the one actual property asset sort that was constructive in 2008. That doesn’t assure this can repeat on this cycle, however as you will notice beneath, there are a lot of causes to consider this can occur once more within the black swan occasion that we discover ourselves in throughout 2020.

Associated: Caught Off-Guard by COVID-19? Prepare Yourself for the Next Black Swan—Here’s How

Right here’s what I really like about this asset class:

- Win-win: Recession resistant and strengthened in financial booms

- Rents are value inelastic: Tenants not significantly price-sensitive

- Tenancy length: Excessive switching prices & perceived vs. Precise size of keep

- Fragmentation: About 75% unbiased operators (high 3 <15%)

- Business dimension: Just like variety of Subway, McDonald’s, & Starbucks mixed

- Administration: Straightforward to handle a mediocre facility—arduous to handle a terrific one

- Highly effective marketing strategy: Mother-and-pop vendor—institutional purchaser

- Potential to satisfy demand: Simplicity of unit reconfiguration

- Ancillary earnings: Important alternatives

- Staffing: Extremely skilled and supported workers vs. lockbox mannequin

- Competitors: Prohibitive value of land for brand spanking new rivals

- Worth-adds: Low-cost alternatives

- Adaptability: Versatile lease phrases & straightforward eviction course of

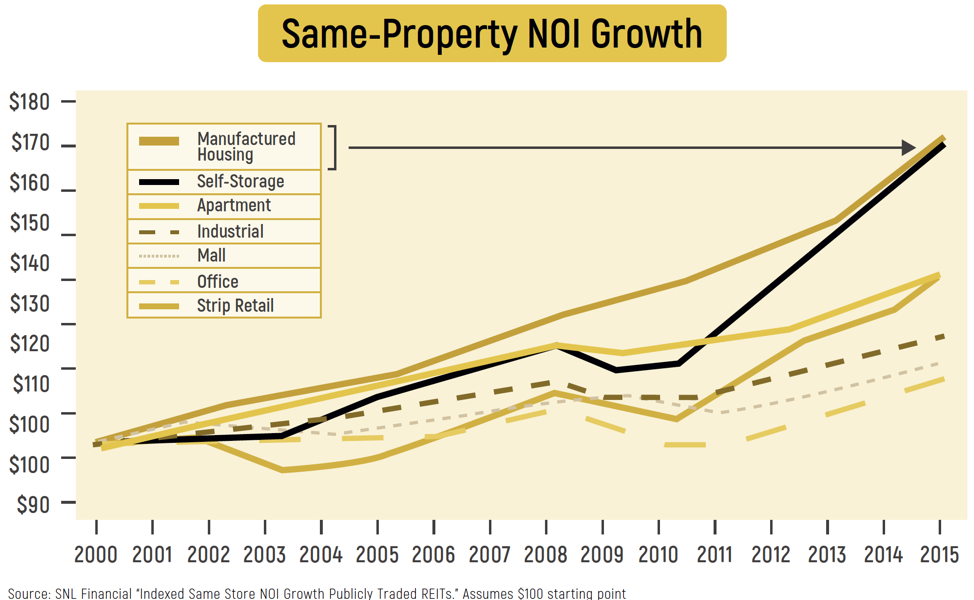

Here’s a graphic exhibiting the efficiency of assorted actual property asset courses since 2000. Manufactured housing and self-storage lead the pack. And take a look at the dip in manufactured housing.

There was no dip!

This doesn’t imply that this cycle will repeat this time round. However it certain is encouraging for these of us who spend money on these two asset courses.

So, Now What?

There could also be just a few extra that may carry out effectively. I’m considering of information facilities and maybe healthcare amenities. I’d look into each of these if I used to be you.

I’ve solely touched on these two recession-resistant asset courses briefly right here. However I’ve written e-books on cellular properties and self-storage. And look out for the brand new guide I’m writing on self-storage investing to be printed by BiggerPockets!

I hope and pray that you just all keep secure on this unprecedented time. And I hope you make the most of this time to arrange for a number of the best investing alternatives of your lives! As a result of they’re proper across the nook.

So, what are you doing to arrange to construct wealth proper now?

Share beneath within the remark part!